disclaimer: This text is not an advice and cannot be treated as such. Especially with international tax, each situation is different. If you are seeking certainty, please contact us or another professional. Our general terms and conditions apply to all work we produce including this article. These terms and conditions contain a limitation of liability clause.

Introduction:

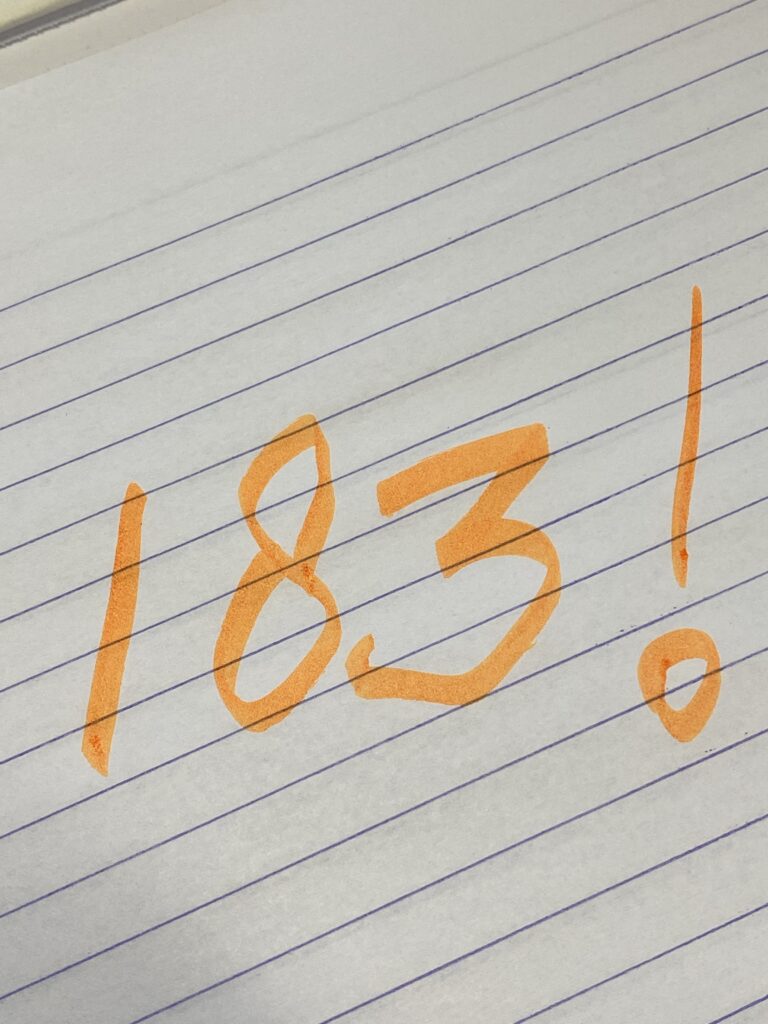

When expats or other persons cross (tax-) borders, they will surely hear about the famous 183-days rule!

Certainly, it is an important term in international tax world. However, this 183-days rule is also often applied incorrectly, even so by professionals. At first, this 183-days rule seems simple, but it often is not.

Therefore, reasons why you may want to read this article are:

- Tax rules that are applied incorrectly, including the 183-days rule, may result in serious time consuming and often expensive problems with tax authorities. In international context, the problems may be twice as big since generally two (or more!) tax authorities are involved, and

- We have experienced a misconception of the 183-days rule and we hope to provide some more insight into this often complex rule.

The 183-rule is generally associated with:

Important to realize is that the first questions to be answered is in which context the 183-days rule is used. Generally, the 183-days rule is associated with:

-

Tax residency:

- Basically meaning, where is a person considered resident for either national tax laws or for tax-treaty purposes?

- It is very important to know your country of tax-residency because the majority, if not all, worldwide tax rules that may apply to you depend on your tax-residency: for example, which country may tax (which part of) your salary, your capital gains, dividends and even your estate upon passing away.

-

Salary:

- furthermore, the 183-days rule is often used in the context of the question where, how and to which extent your salary will be taxed: generally the country of (tax) residency or the country where the work has physically been carried out?

- However, the 183-days rule is sometimes also applied to business income, pension income etc, but this is almost always incorrect (unless it is used in the context of tax residency)!

Re tax residency: did you know that:

- Despite the fact that someone spends more than 183 days in one country, it does not necessarily mean that this person is always considered tax resident of that country (alone)! We are preparing a separate and more detailed article about this topic. Let us know if you wish to receive a copy once finished.

- Although some national tax laws do indeed have a 183-days test in order to determine if someone is considered tax resident, many do not. For example, the US, the Netherlands and South Africa have different rules!

- Assume a person is considered tax resident in two countries (based on national tax rules). Tax treaties may solve such dispute because tax treaties generally contain a residency article that overrides the national rules. But, the majority, if not all, of these tax treaties do not contain a 183-days rule!

Re salary: did you know that:

- Even if you have worked less than 183 days in say country X, you may still be partially taxed in that country! We are preparing a separate and more detailed article about this topic. Let us know if you wish to receive a copy once finished.

Risks associated due to misinterpretation of the 183-rule:

All things considered, misinterpretation of 183 days-rule may have serious (financial) risks, amongst others:

-

double taxation: the tax authorities of different countries may both take the position that you are resident of their country or that your income should be taxed in either country. That is, if you have not taken a clear position in the past. Regretfully, this cannot always be solved by the tax treaty.

-

penalties and high interest charges: as soon as a tax authority realizes that you should have been taxed in their country many years after a taxable event, the tax authorities may tax you retroactively. Especially these retroactive taxes are often combined with penalties and interest charges.

-

high administrative expenses: discussions with one, two or even more tax authorities at the same time may lead to high administrative expenses because you will most likely need assistance from tax lawyers for these often complex and time consuming discussions.

-

Stress! Generally, persons that want to cross borders have a certain reason to do this: this may either be to work in a different country, or to retire or simply to live an adventurous life. Whatever the reason may be, the focus may be seriously spoiled by these often complex and time-consuming discussions.

How to reduce these risks?

Important to realize is that that the tax authorities will assess your situation after your move, or after the work has taken place. Also, this assessment will always be based on facts. In other words, tax laws are never written to take notice of intentions. So, if your intentions do not match with reality, you may at some point be confronted with the above risks.

As such:

- subsequently, the above risks should be avoided prior to the assessment of the tax authorities,

- Therefore, it is important to genuinely understand what the 183-rule is about and how it applies or may apply to you,

- Thirdly, live your life in line with your intentions: to a certain extent you can influence how you will be taxed by adapting your way of living and/or working.

- Unquestionably, take your move seriously and prepare yourself in time prior to the move or prior to take on your new cross-border job. Take at least half a year and preferably one year to prepare (in the tax year prior to the migration).

- Lastly, if your personal situation changes along the way (divorce, marriage, new home, new job, second job): re-assess your situation from time to time!

In our experience, tax authorities also more cooperative with persons that have prepared their case well while being able to support their case with verifiable facts, such as receipts, plain tickets etc.

How to prepare:

Adjusting the way you live and work is something that can best be done in coordination with your tax advisor. We can help you with:

- assessing your current and likely future personal and professional situation upfront,

- predicting where you will most likely be considered tax-resident and what the consequences should be.

- predicting where your income will most likely be taxed under which circumstances.

- Provide you with a reliable contact in other countries than the Netherlands

- file your (Dutch) tax returns, correspond with tax authorities and if needed, objection procedures and litigation.

If any questions, feel free to contact us.

#residency, #tax-residency, #international-tax, #international, #183-days, #183-days rule, #tax authorities, #expat, #crossbordertax, #netherlands